Stress, the University of Twente’s largest study association, organized an awesome guest-lecture with Steve van Wyk, CIO @ ING Bank. The theme of the lecture is “Challenges @ ING” and one of the topics is the merger of the Postbank and ING, the challenges that came with it and how they were overcome.

In this article I will provide some of the interesting topics from the lecture, and for those who haven’t attended this lecture you really missed a great opportunity to have a detailed look at the technology-side of ING.

TABLE OF CONTENTS

Who is Steve Van Wyk and why working for ING ?

Steve van Wyk briefly introduces himself and his family. He has Dutch roots, worked 11 years for Morgan Stanley in the USA and is now at ING for about 5 years now.

Remarkable was the fact that Steve van Wyk was at work in the Twin Towers at 9-11, because Morgan Stanley was at the second floor of tower two ! That day has made tremendous impact, and he will never forget how it required leadership. Not only to get the co-workers safe out of the building, but also a leader in terms of technology (off-load the data to other data centers and get the bank back online as soon as possible).

Honestly I think this is an event that shaped and polished someone as a person. Therefore I’m not surprised by his mantra that there are three important things in professional life:

- People;

- People;

- and people !!

Why ING ?

Steve van Wyk shares three reasons why he loves working for ING:

- Great entrepreneurial and bright people with lots of passion and corporate responsibility;

- ING is an excellent brand and company, with exceptional distribution. Remark for example that ING developed the direct online (banking) model !

- The ability to make a difference, personally as well as inspirational for the surrounding team Steve van Wyk works with on a daily basis.

Later in the Q&A session Steve van Wyk would share that he is most proud of the cultural change within his team and the whole organization, to make a difference and be aware of that ability every day. 🙂

Who is ING?

Despite probably most of us have a bank account at ING bank, it is interesting to ask the question “Who is ING ?” It extends the picture of who Steve van Wyk is and why he started working for ING.

ING

- has 105.000 employees;

- is active in over 40 countries worldwide;

- is serving 85.000.000 clients;

- … and has a rich history of over 130 years !

This rich history of over 130 years, mainly consists of mergers and acquisitions over time which were shown in a nice video “The History of ING“. A complementary overview of the history from ING can also be found on the ING Group wikipedia page. Take also a few minutes to read about the history of the ING lion in the logo of ING Group !

Technology @ ING – Some interesting statistics !

Technology is the ‘heart’ of the bank! Personally I do think that this statement is applicable to almost every company in whatever sector or industry. You simply can’t run a company anymore without technology or proper IT investments.

Steve van Wyk, elaborates on the following statistics, which provide an idea about the magnitude of technology (impact) at ING !

- 11,500 employees working on ING technology side, of which 5,000 work in operations and 5,500 in IT;

- > 3300 applications;

- > 10000 servers;

- > 60000 laptops and desktops;

- and the impressive amount of 5 petabytes of storage !!!

I’m not sure what percentage of servers is already a virtual server. On the Microsoft server and tools website you can read the following text:

“Server virtualization, also known as hardware virtualization, is a hot topic in the IT world because of the potential for serious economic benefits.”

The potential is not only aimed at economic benefits, but it can have a huge environmental impact as well, contribute to the decline of CO2 emissions in the whole IT sector.

Furthermore I was a little impressed about the 5 petabytes of storage, when the 1.5 Terabyte mark of storage has just been passed for consumer hard-disks. Try to imagine what impressive amounts of storage a true web-company like Google uses? Anyway a lot of the banking transactions go digital:

- 160 million euro distributed each day in the Netherlands;

- 100 million euro is turned over at ING every 5 minutes, so calculate the losses for downtime of the systems;

- >200,000 virus attacks per month;

- +/- 16,000 incidents per month;

Quite interesting statistics, right ? In need to complement that 90% of the 16.000 incidents a month go without any disruption visible to the customer. Overall you can see the importance of technology and IT in banking, with a great opportunities for the (near) future !

Integration Postbank & ING (Bank)

One of the topics on the banner of the CIO lecture is the integration of Postbank and ING Bank, which are two independent entities. An obvious question is why integrate the two banks ?

Steve van Wyk explains the field of tension between customer needs and technological developments, and moreover the fact that you have to multiply the resulting investments by 2. Postbank and the ING Bank are two completely different systems, so you have to upgrade both, to compete in the market. Bost from a technical and financial perspective it makes perfectly senses to merge Postbank and ING Bank into a “new” bank.

The Postbank ING Bank merger in operational statistics:

- 9.8 million welcome packages;

- 10 million new banking-cards;

- 2.600 ATM machines re-branded;

And …

- 1.000.000 + lines of code changed;

- 2000+ technology employees involved;

Pretty impressive to change more than 1 million lines of code at the core of the banking system without any disruption of service (for the customer). It requires excellent planning, testing and clever implementation.

- Migrate the data of 660.000 ING Bank customers;

Given the fact that ING and Postbank used completely different systems it is an impressive, technically complex task to migrate the data of 660k customers into the banking system of the “new” bank. When you take into account that daily life goes on, it is even more impressive because ING kept its shop open during the migration process:

- 1.000.000 mortgages administered by ING;

- 2.8 billion transactions through mijn.ing.nl;

The success of the (technical) merger Postbank and ING Bank is mainly driven by excellent technical people with lot of attention for details. Steve van Wyk describes it as “the passion to climb a mountain of complexity!”

Innovations @ ING Bank

Since I’m studying the master Innovation and Entrepreneurship @ University of Twente, this is an interesting part of the presentation.

Join ING Very Easily (JIVE)

Opening a new back-account at ING used to take you 20days, 4 bank visits and 6 mailings. After some thorough analysis of the process, and the application of new fresh approaches the customer leaves the bank with a working debit card and internet banking within 20 minutes.

The people with passion for the service are behind this success, who are “determined to challenge the status quo”. Remark the mantra of Steve van Wyk in the “Who is …” section of the article.

Model Office

The model office is an environment where ING and close technology partners (for example HP) can experiment how the use of new technology can be of strategic advantage.

It is a kind of innovation lab where new customer experience scenarios are tested. For example:

- Your banking card is swallowed by the ATM machine you will directly receive an SMS message on your mobile phone, with a phone number to contact customer service or the directions to the nearest ING office (so you can get a new banking card);

- Your money is swallowed by the ATM machine, because you are distracted and forget to take it out in a certain time-frame. The ATM machine swallows the money, and is directly transferred back to your bank-account. You are notified directly via multiple channels;

- You need to book flight tickets but the balance on your bank account is critical. This innovation here is that a loan is directly and instantly offered to the customer, because it is cleverly integrated into the online ordering and payment process.

A video showed is those scenario’s in a lab-like environment where the different new interactions can be tested and if necessary optimized. It is great to see this kind of experimentation on the cutting edge of technology and business sides of the ING Bank.

- Looking at opportunities that open up thanks to technology;

- Listening to the needs of customers;

- Innovative and creative thinking;

New technology is an enabler for new business models and a driver for new innovations. Not only the “passion for innovation” is key here, but people with an entrepreneurial mindset can really add value to the ING Bank in my personal opinion.

A tool like the business model canvas can really help to set-up different experiments to test new innovations or validate new business- and/or revenue models.

Times are changing, explore the future of ING

Professor Ir. Roel Pieper, explained the techniques of future mapping and scenario planning during the symposium “Vision on the future”. With the rapidly changing times, certainly in terms of technology, these techniques become relevant tools to anticipate on future changes. However lets have a look at how times changed for ING.

Times are changing, rapidly

- Traditionally people deposited their money into banks;

- It was kept in safes … it was accessed through checks;

- Today, trillions of banking transactions fly through cyberspace with astonishing speed;

Without any doubt the traditional way of banking has taken a few leaps, with technology as a main driver. It’s impossible to imagine life today without internet banking and banking cards.

- You don’t need 150 years of tradition to start a bank anymore;

- Internet and mobile technology opens the door to many competitors for traditional banks …. and perhaps takes banks out of the equation;

- People don’t need banks, they need banking !

- What of Google starts a bank tomorrow ?

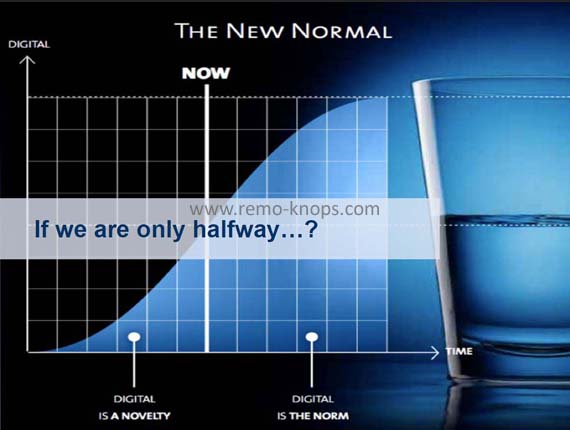

- Digital is the new norm, and what if we are only half way ?

PayPal is one of the examples that directly comes up in my mind, when I think about competition -driven by internet- for banks. PayPal facilitates banking, however you still need to connect the PayPal account to an existing bank account.

“What if Google starts a bank tomorrow ?”

This is a highly exciting and very interesting future scenario to think about. Google has the financial means, the company has a strong focus on services, and Google is a motor for economic growth. In concept it doesn’t seem a big step from a service like Google Checkout to “Google Bank”. I bet there are a lot of technical implications, but moreover the legal implications might be a temporary showstopper. If this future scenario happens ING needs to think about clever ways to stay competitive, and add value for end-users of their services. The customer perspective is key ! 🙂

Some future scenario’s

- 10.000.000 new mobile subscribers per month in India;

- Peer-to-peer lending: What if transferring money is as simple as bumping your phones together ?;

While the 10 million is a highly impressive number, but the more interesting part is that it gives access to potentional new banking customers. In this scenario the mobile (smart)phone, will replace the internet banking scenario’s we have here in the Netherlands and there won’t be as many bank offices in India. This means a tremendous opportunity in emerging markets to attract new customers to the ING Bank.

In the Netherlands we certainly see trends towards mobile banking as well. Mobile banking applications are available on different mobile operating systems. Steve van Wyk discussed the ING Direct Online service on the iPhone briefly. But there are more challenges and opportunities in the future:

- New devices will allow to make truly intelligent use of digital information;

- Augmented reality, geo-location, biometrics and mobile payments. –> “Anyone, Anywhere, Anytime”;

- Morph: stretchable & flexible mobile devices using nanotechnology materials;

The last bullet is highly fascinating. I was fortunate to visit a meeting of VentureLab Twente, where Dave Blank, Scientific director MESA+ Institute for Nanotechnology, shared awesome stories about current research in nano-technology. It really opened a view into an interesting world with infinite opportunities for future products and services. It is a really interesting field …

These future scenario’s provide a lot of opportunities, but also a lot of uncertainty. Steve van Wyk, CIO ING, closes the lecture with two main questions for the future to think about:

- Who will control the future of finance ?

- What will a bank look like in the “second half” ? How van we build this bank ?

Overall conclusions and wrap-up CIO Lecture

First I would like to compliment study association Stress with the excellent organization of the CIO Lecture and the ability to attract a top employer like ING. More important it is really interesting to attend a lecture from someone at the corporate level from ING.

Steve van Wyk provided great insights into the technology challenges at ING. However he also addressed the merger of Postbank and ING from a technical perspective, and explored the experiments for innovation and future scenario’s of competitive advantage with the attendees. It was a great session, especially the last to parts were perfectly suited for people with an entrepreneurial skillset. 🙂

I will personally remember Steve van Wyk as the CIO who made a short introduction round through the lecture room, introduced himself personally to a few students (I was lucky to be one of them), and have a short conversation with them. Remarkable was also his statement that by the time you are graduated, about 25% of the learned knowledge is already superseded !

You can furthermore see that human capital is the most highly important at ING, and with people like Steve van Wyk on the corporate level people will be the most important value for ING, despite all technological developments.

About Stress, study association for Business Administration […]

“Stress is the University of Twente’s (UT) study association for Business Administration (BA), International Business Administration (IBA), Industrial Engineering and Management (IE&M) and Business Information Technology (BIT) and was founded on May 21st, 1974. Currently, Stress has around 2500 members and is the largest UT study association.”

On 18-11-2019 I’ve added a comment to this post (previously lost in a ransomware attack):

The scenario: “What if Google starts a bank” is becoming reality. Read the Wall Street Journal article below:

“Hey Google, what’s my balance?” The tech giant is getting into the banking business.

// Remo

Great to see that ING is still driving innovation: “Banking on innovation: How ING uses generative AI to put people first”

It seems like ING is changing the “Platform operating model for the AI bank of the future” Download a pdf-file from McKinsey to learn more.